Individuals Are Selling Their Bitcoin at the Fastest Pace Ever

Marty's Bent

Sup, freaks. In 2025 individuals sold more than 696,000 bitcoin as businesses, funds, ETFs, and governments took close to 1 million bitcoin off the market. That's more than 3% of the total supply leaving the hands of individual holders in a single year. What's going on, and what should you do about it?

> Massive Bitcoin ownership change in 2025.

>

> Businesses added 489K BTC while individuals reduced holdings by 696K BTC. [pic.twitter.com/1YhFdFB2if](https://t.co/1YhFdFB2if?ref=tftc.io)

>

> — TFTC (@TFTC21) [February 17, 2026](https://twitter.com/TFTC21/status/2023845914964881567?ref_src=twsrc%5Etfw&ref=tftc.io)

A new annual report from [River](https://river.com/tftc?ref=tftc.io), who consistently puts out great research, is set to be released later this week. The teased the report by sharing the slide above which shows the 2025 rotation in bitcoin ownership. Almost 700,000 bitcoin left the hands of individuals and floated onto the balance sheets of businesses (predominantly publicly traded companies executing bitcoin treasury strategies), institutional funds, ETFs, and governments that have entered the mad dash for bitcoin. There will only ever be 21 million and, as we've been covering for the last few years, institutions are claiming their stake. The precipitous fall in individual ownership is a continuation of a trend that began in earnest in 2024, when individuals were net sellers of more than 500,000 bitcoin. 2025 proved to be a year of acceleration for this particular trend.

If you've been following the tea leaves, particularly over the last six months, you know part of what's been driving this. When bitcoin hit $124,000 late last year, a ton of OG whales opened up old wallets and sold at the all-time highs. On-chain data confirms this. Many of these holders had been in for well over a decade with a cost basis anywhere between dozens of cents to a few hundred dollars and decided to lock in life changing gains by cashing out of their stack.

I think it would be remiss of me not to mention that the economy was likely a major factor of some of the selling we've seen in recent months. A lot of individuals out there are hurting and have been forced sellers because they need to maintain their lifestyles and pay their bills. Bitcoin is the most liquid asset in the world trading 24/7/365, it's fungible, you are able to sell it in seconds from an app on your phone and have it transferred to your bank account within minutes (if you use an exchange with instant withdraws). If you're in a cash crunch, bitcoin is going to be one of the first assets to go.

This concept works at different scales. The person who needs quick liquidity to handle monthly bills has the same ability as the institutional trader who is levered to the tits and needs to meet margin calls across his portfolio. If it looks like markets are going to trade down when they open on Monday morning due to some geopolitical risk, rumblings of a liquidity crisis, or the newest frontier AI model obsoleting a who sub-sector of the B2B SaaS sector overnight bitcoin will be the first asset to be sold off so positions can be defended.

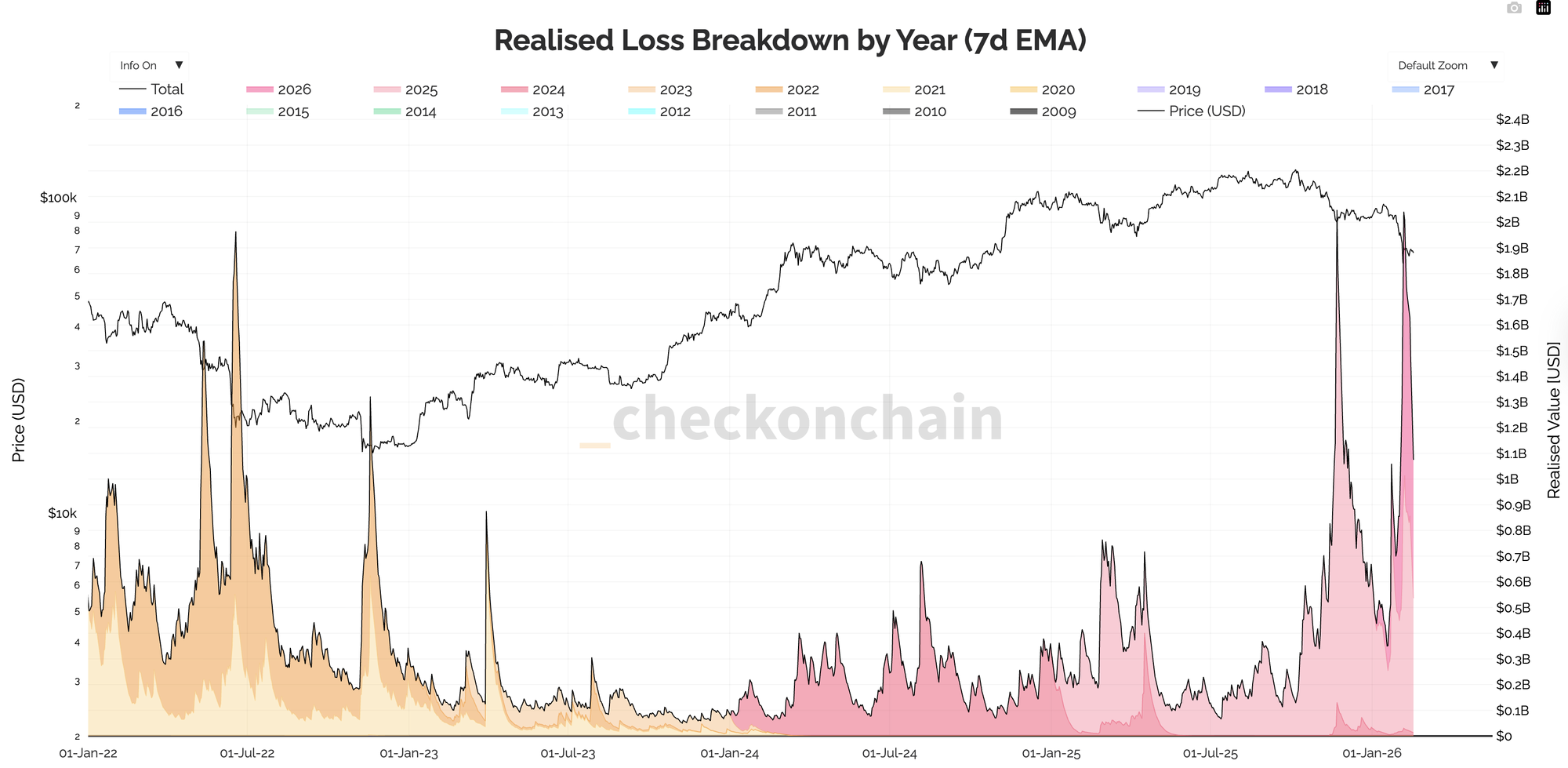

Regardless of the scale of your sells over the last four months, it is likely that you have realized some losses if you were selling. The two red spikes on the right hand of the chart below show many bitcoin holders sold at a loss when bitcoin first fell back below $100,000 after peaking out at $124,000 and at the beginning of this month when the price dipped below $80,000 and then cratered through the $70,000 and $60,000 range and Eskimo kissed $59,000.

As for where we are in this cycle, our good friend James Check highlighted in his [latest Check on Chain newsletter](https://newsletter.checkonchain.com/p/insuring-the-ashes?ref=tftc.io) that he believes there has been a capitulation and the market is currently trying to find its sea legs. He believes we are in the "time pain" part of the bear market where we chopsolidate in a relatively tight range for some months before staging a true recovery.

On the other side of the selling has been bitcoin treasury companies like Strategy, Metaplanet, Semler Scientific, and others raising capital in public markets to buy bitcoin. Whether these strategies are sustainable long term is yet to be determined, but they've funneled a ton of money into bitcoin at an accelerated pace throughout 2025.

I'm not going to try and predict price here in this rag. We're all here for the fundamentals. Bitcoin is a distributed peer-to-peer cash system with no centralized issuer. The fact that you can send money 24/7/365 without permission from a centralized third party, audit the system with software downloaded on your computer, and self-custody your life savings in a relatively discrete fashion is invaluable.

> Keep your cash flow up.

>

> Stay humble.

>

> Stack sats.

>

> Sweep to cold storage.

>

> Your children will thank you. [https://t.co/6vWo4b0HAy](https://t.co/6vWo4b0HAy?ref=tftc.io)

>

> — Marty Bent (@MartyBent) [February 17, 2026](https://twitter.com/MartyBent/status/2023852681631330394?ref_src=twsrc%5Etfw&ref=tftc.io)

When despair enters the market and you begin questioning why you're here in the first place is the time to get back to basics. This is a game of survival and if you're going to survive you have to abide by some pretty simple rules.

Firstly, you have to keep your cash flow up. To avoid coming off as insensitive I want to clearly acknowledge that a lot of people are struggling with this as inflation has ravaged the economy over the last six years. It's harder for people to make enough money to cover expenses and squirrel away savings in bitcoin. Many people make the terrible mistake of seeing bitcoin hit a new all-time high and thinking they can quit their jobs. Don't do this. It's a great way to lose your bitcoin. Bitcoin is volatile. It fluctuates violently, but consistently trends up and to the right over time. You never want to never want to put yourself in a position where you don't have cash flow to cover expenses and end up a forced seller.

In that same vein, a lot of people are getting wiped out because they took on too much levered debt in the form of bitcoin collateralized loans. My rule of thumb: no more than 10% of your stack should be in a bitcoin collateralized loan at any given point in time. If you're taking one out at all-time highs, be prepared to top up margin when the price corrects. Bitcoin collateralized loans are great products for those who need them, but you have to know how to use them and when it makes sense. Having consistent cash flow is a great way to avoid the pitfalls of bitcoin collateralized loans because you put yourself in a position where you don't need them.

Lastly, a quick note on the 13F filings making the rounds. Jane Street bought over 7 million shares of IBIT worth $276 million in Q4 2025. A lot of people are saying this is wildly bullish. But it's important to realize that Jane Street is a market maker. They play both sides. They are not naked long 20.3 million shares of IBIT. Take that filing with a grain of salt. They are creating options on top of this which have material short exposure. They could be net short for all we know.

> BREAKING: Jane Street bought 7,105,206 [$IBIT](https://twitter.com/search?q=%24IBIT&src=ctag&ref_src=twsrc%5Etfw&ref=tftc.io) shares worth $276 million in Q4 2025.

>

> It now holds 20,315,780 IBIT shares worth $790 million.

>

> This is the same entity rumoured to be behind the daily “10 AM” manipulation to push Bitcoin prices lower. [pic.twitter.com/NFC5r5hHUn](https://t.co/NFC5r5hHUn?ref=tftc.io)

>

> — Bull Theory (@BullTheoryio) [February 17, 2026](https://twitter.com/BullTheoryio/status/2023769099655147948?ref_src=twsrc%5Etfw&ref=tftc.io)

The real signal out of the 13F filings that have been hitting the tape? Sovereign wealth funds like Mubadala owning 12.7 million shares of IBIT valued at $630.6 million as of December 31st, which is a 46% increase from September 30th. They're not in the business of market making. That's a sovereign actually getting long bitcoin exposure. They may have some short hedges on, but I doubt they're getting as exotic as Jane Street is with their bitcoin play.

> Very important one.

>

> In a filing today, sovereign wealth fund Mubadala reported owning 12.7 million shares of IBIT valued at $630.6 million as of December 31.

>

> That's a 46% increase from 8.7 million shares previously reported as of September 30.

>

> Filing:[https://t.co/vSlYJOg8T7](https://t.co/vSlYJOg8T7?ref=tftc.io)

>

> — MacroScope (@MacroScope17) [February 17, 2026](https://twitter.com/MacroScope17/status/2023804809175076922?ref_src=twsrc%5Etfw&ref=tftc.io)

Take all of this in and think about your personal strategy. There are only ever going to be 21 million bitcoin. The demand drivers are going to continue to diversify beyond individuals towards businesses, funds, governments, and other actors. There's going to be aggressive competition to accumulate as much bitcoin as possible. Some actors have firepower that is many orders of magnitude above your DCA, and they are able to deploy more sophisticated strategies than you'll be able to.

In bitcoin the name of the game is staying in the game.

Corporations, institutions and governments entered the fray of bitcoin accumulation in size in 2025 while individual holders sold.

Keep your cash flow up. Stay humble. Stack sats.

### Lightning Offers Superior Privacy for Stablecoins

The privacy landscape for stablecoins could be fundamentally